Is Now the Proper Time to Get Into Tech?

This tale in the beginning gave the impression on Zacks

Lots of the traders I communicate with are questioning what to do with tech shares at this time. Is it time to shop for? Or does it make sense to attend a little bit longer to get a clearer sense of the field’s path?

At the one hand, many wonder whether shares have climbed too prime, too rapid.

Take Netflix and Meta (previously Fb) as examples. Each just lately plummeted 20% following disappointing profits bulletins and wary ahead steerage… wiping $100s of billions out of the marketplace within the blink of an eye fixed.

That form of worth motion could make even probably the most grizzled making an investment veteran balk – particularly for many who keep in mind the Tech Destroy of the early 2000s.

However, many traders see the pullbacks and volatility as a purchasing alternative. It’s been 2 years since a few of these giant names were priced so low.

Imagine me, I am getting it.

However in the event you’ve hesitated in any respect to spend money on tech shares, you might be lacking out on probably the most greatest benefit alternatives out there these days.

Believe the next:

It kind of feels like only some years in the past, such things as video telephone calls and self-driving vehicles gave the look of a distant dream.

Now we see those inventions regularly.

Because the pandemic began, innovation of recent applied sciences has speeded up much more.

Now not simplest have those glossy new services captivated our imaginations, however they have got additionally been a significant drive powering file company profits and the historical bull marketplace run.

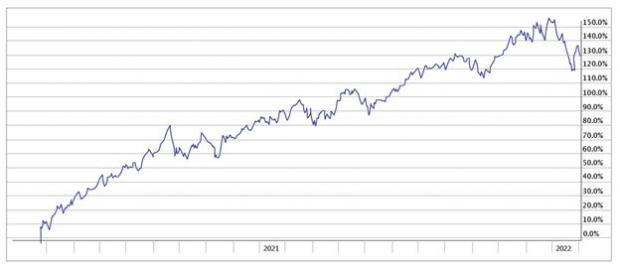

Regardless of the indigestion traders have skilled over the last few weeks, the tech sector has surged +130% since remaining March. Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

If truth be told, the hot weak spot on this area has created much more compelling alternatives to shop for.

Call for That Helps to keep Rising and Rising

Taking a look on the tech panorama, there are 3 causes for shares to climb.

Extra . . .

——————————————————————————————————

Should-See Tech Inventory for 2022 (Triple-Digit Benefit Attainable)

Fueled via the worldwide semiconductor scarcity, one semiconductor inventory is poised to skyrocket in 2022 and past.

The corporate is one-fourth of one% the dimensions of Intel, nevertheless it’s rising FAST. The “tiny” tech inventory has already climbed +663% since pandemic lows.

Its subsequent leg upper might be similarly winning for traders who transfer briefly.

See this inventory now >>

——————————————————————————————————

1) Business call for for tech-related services hasn’t ever been better. New era brings in larger productiveness, collaboration and protection. And with the speedy enlargement of blockchain era and cryptocurrencies, the Web of Issues and the growth of 5G networks, you’ll be expecting to look even larger strides within the days to come back.

2) Shoppers are including tech toys to an increasing number of spaces of our lives. It isn’t simply mobile phones; now we have sensible watches, sensible house units just like the Amazon Echo or Google House, and digital truth units akin to Meta’s Oculus Rift, which might revel in exponential enlargement because the “metaverse” starts to head mainstream.

3) Researchers are proceeding to push additional into territory up to now not possible.

For instance, scientists have era not to simplest map out the human genome, however to edit it. We might be able to merely delete illnesses proper out of our DNA!

Numerous computer systems and machines are being constructed with talent to be told independently, with out being programmed via people. This “gadget finding out” allows laptop techniques to modify when uncovered to new knowledge.

Talking of information, web visitors has exploded over the last 2 years – and it is anticipated to continue to grow. Knowledge facilities are making an investment masses of billions of bucks to improve their infrastructure to maintain the weight.

The place this type of innovation meets ever-increasing intake, there may be possible for implausible enlargement.

Which Tech Shares Must You Pay Consideration to Proper Now?

As you’ll see, the tech sector is already having an enormous affect on virtually each and every phase of society. The selection of thrilling probabilities will simplest build up as extra firms and industries build up their use of leap forward era within the days to come back.

As an investor, you’ll for sure attempt to goal firms which might be the tip customers of the most recent traits, however why no longer center of attention on something each and every of those firms has in not unusual?

One unmarried element principally drives the luck of all of the tech area: semiconductors.

Tech firms actually can not serve as with out them. That suggests the call for for those units is more likely to develop a minimum of as rapid because the tech sector as an entire.

And as you’ve observed within the information in recent years, the intense call for for semiconductors has created a scarcity of those essential elements.

There’s a catch. There are 38 publicly-owned firms within the electronics-semiconductor trade. Choosing the right inventory may also be tough.

Zacks’ Best Select to Capitalize on This Alternative

However to not fear. Zacks has simply launched One Semiconductor Inventory Stands to Achieve the Maximum, a Particular Document revealing the little-known corporate poised to skyrocket greater than another.

This corporate is only a fraction of the dimensions of the massive identify chipmakers like Intel and Nvidia, so maximum traders have by no means heard of it. However that can alternate quickly, because it ramps up manufacturing for firms all over the world (together with Apple). Percentage costs climbed 7X, and after the hot pullback, the following leg up might be simply as profitable for traders who get in early.

I urge you to try this file in an instant. Your probability to get admission to our file ends Sunday, February 13.

Get the Document Now >>

Highest,

Brian Bolan

Competitive Expansion Strategist

Brian Bolan is our competitive enlargement professional and the editor of the Zacks Era Innovators portfolio.

– Zacks

– Zacks

Need the most recent suggestions from Zacks Funding Analysis? Nowadays, you’ll obtain 7 Highest Shares for the Subsequent 30 Days. Click on to get this loose file

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis