Is MarineMax (HZO) a Appropriate Price Investor Inventory Now?

Price making an investment is definitely one of the crucial common techniques to seek out nice shares in any marketplace surroundings. In any case, who wouldn’t wish to to find shares which are both flying below the radar and are compelling buys, or be offering up tantalizing reductions when in comparison to truthful cost?

– Zacks

– Zacks

One approach to to find those corporations is through having a look at a number of key metrics and fiscal ratios, a lot of that are a very powerful within the cost inventory variety procedure. Let’s put MarineMax, Inc. HZO inventory into this equation and to find out if this is a sensible choice for value-oriented buyers presently, or if buyers subscribing to this system must glance in different places for most sensible selections:

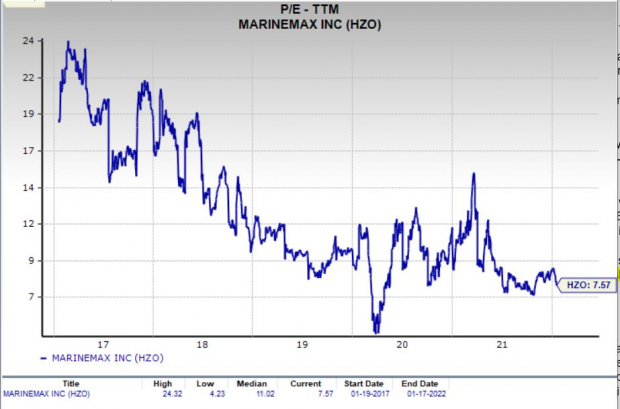

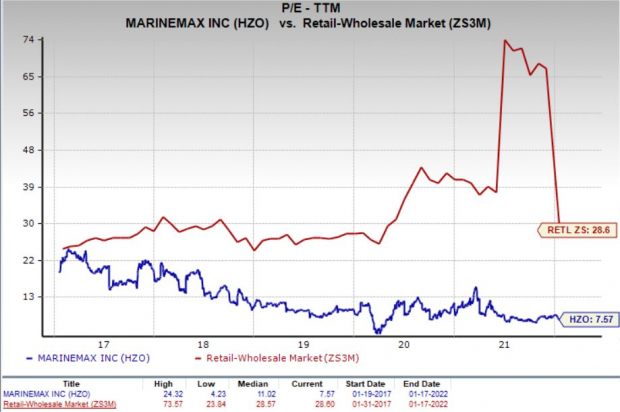

PE Ratio

A key metric that cost buyers at all times take a look at is the Value to Profits Ratio, or PE for brief. This presentations us how a lot buyers are keen to pay for every buck of income in a given inventory, and is definitely one of the crucial common monetary ratios on this planet. The most productive use of the PE ratio is to check the inventory’s present PE ratio with: a) the place this ratio has been previously; b) the way it compares to the typical for the business/sector; and c) the way it compares to the marketplace as a complete.

In this entrance, MarineMax has a trailing 365 days PE ratio of seven.57, as you’ll see within the chart underneath:

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

This degree if truth be told compares beautiful favorably with the marketplace at massive, because the PE for the S&P 500 stands at about 24.27. If we focal point at the long-term PE development, MarineMax’s present PE degree places it underneath its midpoint during the last 5 years.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Additional, the inventory’s PE compares favorably with the Zacks Retail-Wholesale sector’s trailing 365 days PE ratio, which stands at 28.6. On the very least, this means that the inventory is quite undervalued presently, in comparison to its friends.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

We must additionally indicate that MarineMax has a ahead PE ratio (value relative to this 12 months’s income) of simply 6.9, so it’s truthful to mention {that a} moderately extra value-oriented trail could also be forward for MarineMax inventory within the close to time period too.

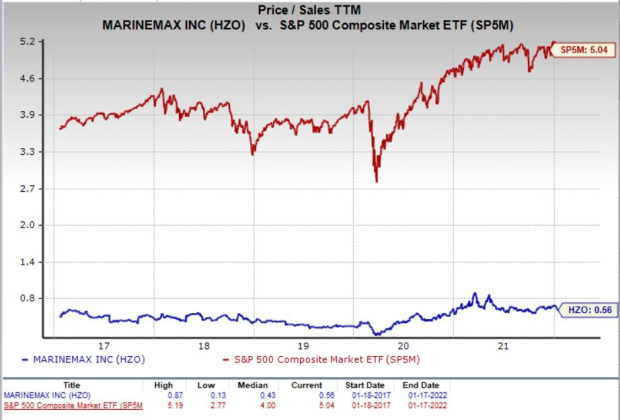

P/S Ratio

Some other key metric to notice is the Value/Gross sales ratio. This way compares a given inventory’s value to its general gross sales, the place a decrease studying is normally regarded as higher. Some other folks like this metric greater than different value-focused ones as it appears at gross sales, one thing this is some distance tougher to govern with accounting tips than income.

At the moment, MarineMax has a P/S ratio of about 0.26. That is not up to the S&P 500 reasonable, which is available in at 5.04 presently. Additionally, as we will see within the chart underneath, that is underneath the highs for this inventory specifically during the last few years.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

If anything else, HZO is within the decrease finish of its vary within the period of time from a P/S metric, suggesting some degree of undervalued buying and selling—no less than in comparison to ancient norms.

Extensive Price Outlook

In mixture,MarineMax lately has a Zacks Price Rating of A, striking it into the highest 20% of all shares we quilt from this glance. This makes MarineMax a forged selection for cost buyers.

What In regards to the Inventory General?

Despite the fact that MarineMax could be a sensible choice for cost buyers, there are many different components to imagine sooner than making an investment on this title. Particularly, it’s price noting that the corporate has a Enlargement Rating of F and a Momentum Rating of C. This provides HZO a Zacks VGM rating — or its overarching elementary grade — of A. (You’ll learn extra concerning the Zacks Taste Rankings right here >>)

In the meantime, the corporate’s fresh income estimates had been encouraging. The present 12 months has observed 5 estimates pass upper previously sixty days in comparison to 3 decrease, whilst the whole 12 months 2021 estimate has observed 3 upward revision in comparison to one downward in the similar period of time.

This has had a good affect at the consensus estimate regardless that as the present 12 months consensus estimate has progressed through 19.7% previously two months, whilst the whole 12 months 2021 estimate has risen through 1.4%. You’ll see the consensus estimate development and up to date value motion for the inventory within the chart underneath:

In spite of this sure development, the inventory has a Zacks Rank #3 (Grasp), which signifies expectancies of in-line efficiency from the corporate within the close to time period.

Backside Line

MarineMax is an impressed selection for cost buyers, as it’s arduous to overcome its improbable line up of statistics in this entrance. A robust business rank (amongst most sensible 29% of greater than 250 industries) additional instils our self assurance.

On the other hand, during the last two years, the Zacks Retail – Miscellaneous business has obviously underperformed the marketplace at massive, as you’ll see underneath:

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

So, cost buyers would possibly wish to look ahead to business traits to show round on this title first, however as soon as that occurs, this inventory can be a compelling select.

Simply Launched: Zacks Best 10 Shares for 2022

Along with the funding concepts mentioned above, do you want to find out about our 10 most sensible selections for the whole lot of 2022?

From inception in 2012 thru 2021, the Zacks Best 10 Shares portfolios won an outstanding +1,001.2% as opposed to the S&P 500’s +348.7%. Now our Director of Analysis has combed thru 4,000 corporations lined through the Zacks Rank and has handpicked the most efficient 10 tickers to shop for and grasp. Don’t omit your likelihood to get in…since the faster you do, the extra upside you stand to take hold of.

See Shares Now >>

Need the most recent suggestions from Zacks Funding Analysis? These days, you’ll obtain 7 Highest Shares for the Subsequent 30 Days. Click on to get this unfastened record

MarineMax, Inc. (HZO): Unfastened Inventory Research Record

To learn this newsletter on Zacks.com click on right here.