5 Shares Providing Publicity to the Promising Semiconductor Business

Whilst provide constraints impacting some gamers are prone to proceed thru a lot of this yr, the robust call for setting is main to worth will increase and long-term provide agreements (for some).

The longer-lasting have an effect on of the pandemic is overwhelmingly sure for the business as it supplies the development blocks of era that everybody is depending on for keeping up social distancing and far flung operations.

Additionally, technological developments in the best way we do computing, in addition to synthetic intelligence, Web of Issues, 5G, driverless automobiles and a number of different issues that can very much build up our reliance at the virtual international are secular drivers for the business.

Due to this fact, there are massive possibilities on this marketplace and it’s a spot we must all be in. Our present alternatives are Analog Units, Microchip Era, Monolithic Energy Techniques, NXP Semiconductors and ON Semiconductor.

– Zacks

– Zacks

About The Business

We most often use our digital devices with out considering, anticipating them to appropriately learn our instructions, and file, retailer, retrieve and procedure the ideas we throw at them. The complicated procedure that makes this imaginable is enabled through semiconductor era, whether or not analog (enabling the recording and size of real-world data), virtual (processing data to be had in machine-readable language) or combined sign (enabling conversion of analog indicators to virtual or virtual to analog amongst different issues). Maximum digital devices use a mixture of those elements.

The business is cyclical and costs are elastic. Given their utility throughout automobile, communications, computing/cloud/knowledge heart, business, clinical, IoT and different markets, those semiconductor providers serve a couple of markets that offset their person seasonality.

Components Using The Business

- The expanding use of electronics in cars, airplanes and protection apparatus; higher manufacturing facility automation; higher penetration of smartphones, capsules, notebooks, PCs and all approach of private computing and different non-public units and sensible family home equipment; communications infrastructure transferring to 5G; higher reliance on cloud infrastructure; the arrival of man-made intelligence (AI), the Web of Issues (IoT), extra complicated clinical units, EVs, self-driving automobiles and so on is resulting in unheard of call for for semiconductor chips. Since we merely aren’t making as many chips as we’d like, provide chains are being optimized to the utmost. For the reason that pandemic hit in one of these scenario, producers had no choice however to divert manufacturing to objects right away in call for, which on this case had been the cloud, home items, non-public computing and units, and so on. It helped that automakers scale back orders at round this time in anticipation of a chronic weak point available in the market. But if other people sought after to transport out once more, they most well-liked their very own transportation, which higher call for for cars. However manufacturing diverted to those different issues merely couldn’t be redirected at such brief understand. And for this reason at the back of the international chip scarcity. Corporate chiefs are guessing that the nice scarcity will proceed thru maximum of this yr regardless of really extensive effort to redirect some manufacturing and in addition convey new capability on-line. This must make stronger endured power in costs.

- With vaccines rolling out abruptly, many segments of the economic system that had been best in part operational are anticipated to open up whilst no longer the entire paintings and college that moved house is coming again. That is resulting in the hybrid type, the place extra other people transfer out in their houses extra continuously however no longer always. The expectancy is for the go back of a definite stage of normalcy in the second one part of the yr, however with flexibility to do business from home changing into one thing that many employers and workers need, the growth of the total digital footprint seems everlasting. So, call for for normal computing apparatus like PCs and newer-age capsules must stay robust. Client units incorporating more recent applied sciences to allow extra reports, will upload to this call for. The selection of semiconductors in keeping with software and their complexities can even proceed to extend. R&D budgets fascinated by responding to higher pageant and the increasing scope of digitization will due to this fact additionally build up.

- Secular drivers for the business are knowledge heart enlargement (from the ongoing shift in workloads to the cloud, which used to be speeded up through the virus), the arrival of man-made intelligence (which is very large as a result of it is going to permeate each facet of existence and dwelling and remains to be a marketplace within the making), IoT (which is some other marketplace within the making and can enormously amplify the scope of computing) computerized cars (AVs) and electrical cars (EVs) (that use many extra chips than conventional auto).

- The adoption of 5G communications era, enabling 10X the knowledge charge as 4G, is some other spice up to analog-mixed sign gross sales each in base stations and finish units. On account of the a couple of enter (MI) and a couple of output (MO) streams the era will allow in base stations, call for for sensors and gear control analog together with envelope monitoring chips (to control extra persistent float and thus scale back heating), in addition to gallium nitride (GaN) fabrics will build up. Additionally, since 5G is best concerned with brief vary indicators, it is going to no longer utterly change 4G however will complement it. So it is going to be additive on the subject of element call for. With the economic system proceeding to open up and the virus taking a look adore it’s on its technique to changing into endemic, this section must best get more potent.

- Business consolidation continues as the fee and headaches of constructing chips rises in an atmosphere the place the adoption of semiconductors in units of various worth calls for costs to say no. Acquisitions also are pushed through the wish to amplify functions and procure of key skill.

- U.S. that executive officers concern that not one of the maximum complicated chips are lately manufactured within the nation. This is regarded as to be a countrywide safety worry for the reason that semiconductors are taking part in an increasingly more better position in AI-driven digital weaponry and surveillance mechanisms. So the federal government is making an attempt to incentivize corporations to construct within the U.S. TSM, the principle provider to the U.S. is putting in within the nation however the plan is to have this on a miles better scale. How precisely this case will play out for the business is unknown. Expanding capability would depress costs. And U.S. manufacturing would build up value. Such a lot will depend on what the federal government bears.

Zacks Business Rank Signifies Sexy Potentialities

The Zacks Semiconductor – Analog and Mixedindustry is housed throughout the broader Zacks Pc and Technologysector. It carries a Zacks Business Rank #36, which puts it on the most sensible 14% of greater than 250 Zacks-classified industries.

The gang’s Zacks Business Rank, which is principally the common of the Zacks Rank of the entire member shares, signifies horny near-term possibilities. Our analysis displays that the highest 50% of the Zacks-ranked industries outperforms the ground 50% through an element of greater than 2 to at least one.

The business’s positioning within the most sensible 50% of the Zacks-ranked industries is a results of sure revenue outlook for the constituent corporations in mixture. Taking a look on the mixture revenue estimate revisions during the last yr, it’s transparent that analysts are constructive about this staff’s revenue enlargement possible. So 2021 estimates have risen 31.9% during the last yr, whilst 2022 estimates have risen 27.2%.

Earlier than we provide a couple of shares that you could need to imagine in your portfolio, let’s check out the business’s fresh stock-market efficiency and valuation image.

Inventory Marketplace Efficiency Is Reasonable

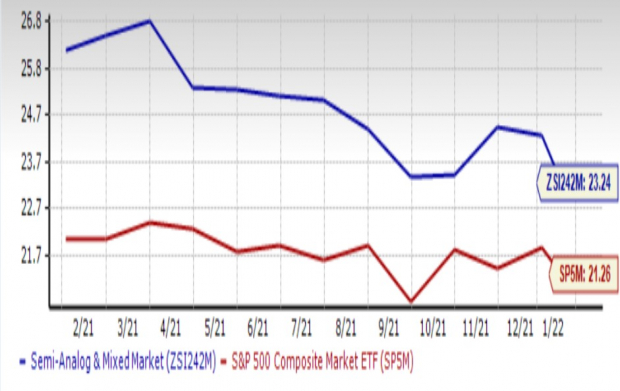

The Zacks Semiconductor – Analog and Combined business has lagged the wider Zacks Pc and Era Sector in addition to the S&P 500 index although a lot of the previous yr. But it surely has pulled forward of the wider sector in December.

Total, the business added 20.6% to its worth during the last yr whilst the wider sector added 18.0% and the S&P 500 24.6%.

One-12 months Worth Efficiency

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Business???’s Present Valuation

Even if buying and selling at a better a couple of than the S&P 500 at the foundation of ahead 12-month price-to-earnings (P/E) ratio, it’s 7.3% under its personal median worth during the last yr. The S&P 500 is buying and selling at a decrease a couple of however is best 2.8% under its median stage. So now, the business’s a couple of is 23.24X whilst to the S&P 500’s 21.26X. It’s then again fairly undervalued in comparison to the sphere’s forward-12-month P/E of 27.13X.

The business is lately buying and selling at its lowest level of 25.08X during the last yr. Its absolute best level during the last yr is 26.77X.

Ahead 12 Month Worth-to-Profits (P/E) Ratio

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

5 Promising Shares Providing Publicity To The Business

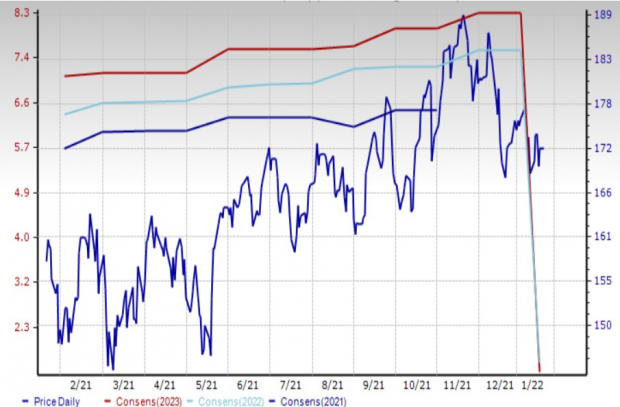

Analog Units (ADI): The corporate’s built-in circuits be offering small shape issue, low-power, radio-frequency (RF) analog and combined sign semiconductor merchandise together with converters, persistent control merchandise, amplifiers, RF and microwave ICS, accelerometers, gyroscopes and a number of different merchandise, basically centered on the business, automobile, shopper, instrumentation, aerospace, and communications markets.

Analog Devics has benefited from power within the business and automobile markets, which reached all-time highs in fiscal 2021 (finishing October). Top-end shopper additionally delivered robust enlargement. The Maxim acquisition introduced engineering skill and in addition expanded the product portfolio. Given the extent of call for, Analog Units is including capability, which must make stronger its long run enlargement.

Analog Units beat estimates through 2.4% within the final quarter. Its fiscal 2022 EPS estimate has higher 37 cents (5.2%) within the final 60 days whilst the 2023 estimate higher 30 cents (3.8%).

Stocks of this Zacks Rank #1 (Sturdy Purchase) inventory are up 9.0% previously yr.

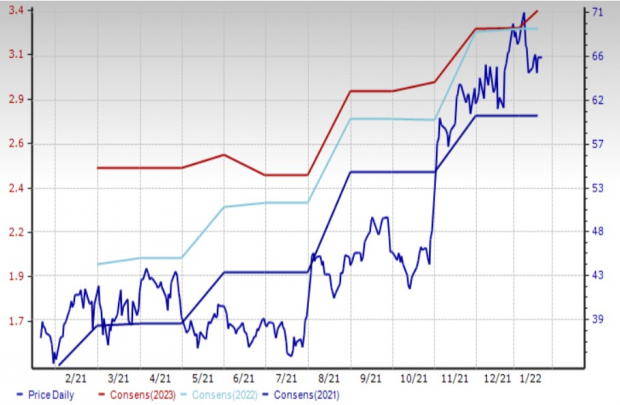

Worth and Consensus: ADI

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Microchip Era Included (MCHP): Microchip develops and manufactures microcontrollers, reminiscence and analog and interface merchandise for embedded regulate programs, which can be small, low-power computer systems designed to accomplish explicit duties.

The corporate’s revenues stagnated thru 2020 however have picked up strongly since then. It’s lately seeing explicit power within the automobile, business and shopper markets, which can be seeing above-seasonal power. Low channel inventories and provide constraints are elevating some subject material and subcontracting prices whilst top call for is permitting payment will increase. Regardless of extension of capability, the exceptionally top call for is permitting the corporate to construct backlog extending well past the present quarter. Additionally, many of the backlog, particularly in constrained spaces, is coming thru its Most well-liked Provide Program, which additional improves visibility. Additionally it is refinancing its debt on extra favorable phrases whilst extending maturities. Control continues to extend the dividend.

The corporate efficiency within the final quarter used to be roughly consistent with the Zacks Consensus Estimate and the estimate for fiscal 2022 (finishing March) higher a few cents within the final 60 days. The 2023 estimate higher 6 cents in the similar time frame.

The stocks of this Zacks Rank #2 (Purchase) corporate are up 13.4% during the last yr.

Worth and Consensus: MCHP

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

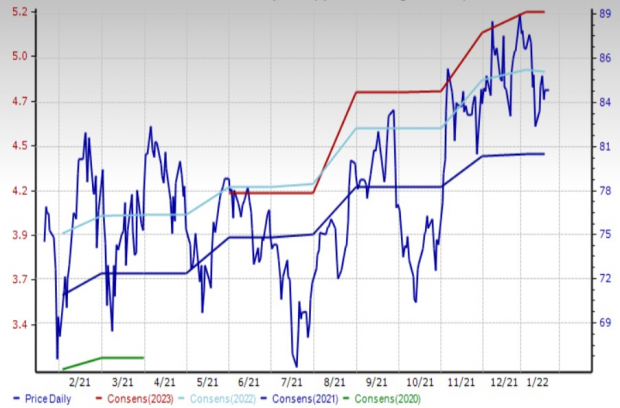

Monolithic Energy Techniques (MPWR): The corporate designs, develops, and markets built-in persistent semiconductor answers and gear supply architectures for computing and garage, automobile, business, communique, and shopper programs markets.

Monolithic Energy has no longer felt any adverse have an effect on from the pandemic in any respect. In truth, being a semiconductor corporate, it’s been one of the crucial enablers of the virtual economic system that supported the economic system all the way through this time. Because of this, the corporate has observed specifically robust income enlargement from the June quarter of 2020. It has additionally benefited from its long-term buyer relationships and proportion features, specifically in higher-margin classes. That is serving to the corporate to soak up the emerging prices with out a lot have an effect on on its final analysis.

Monolithic Energy crowned estimates through 3.0% within the final quarter. Its 2021 EPS estimate has higher 10 cents (1.4%) within the final 90 days. Moreover, its 2022 estimate higher 33 cents (4.0%).

Stocks of this Zacks Rank #2 inventory are up 15.5% during the last yr.

Worth and Consensus: MPWR

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

NXP Semiconductors N.V. (NXPI): The corporate gives microcontrollers, utility processors, communique processors, wi-fi connectivity answers, analog and interface units, RF persistent amplifiers, safety controllers, and semiconductor-based environmental and inertial sensors, together with force, inertial, magnetic, and gyroscopic sensors. Its merchandise are basically centered on the automobile, business, IoT, cell and communique infrastructure markets.

The robust call for NXPI is lately seeing is predicted given its vital publicity to auto and business finish markets. The corporate has ready to send larger volumes given the constrained setting and expects the placement to generate further income thru this yr.

NXP beat estimates through 2.9% within the final quarter. The Zacks Consensus Estimate for 2021 has jumped 27 cents (2.6%) within the final 90 days. The 2022 estimate jumped 55 cents (4.8%) all the way through the similar length.

#2 ranked NXP stocks are up 30.8% during the last yr.

Worth and Consensus: NXPI

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

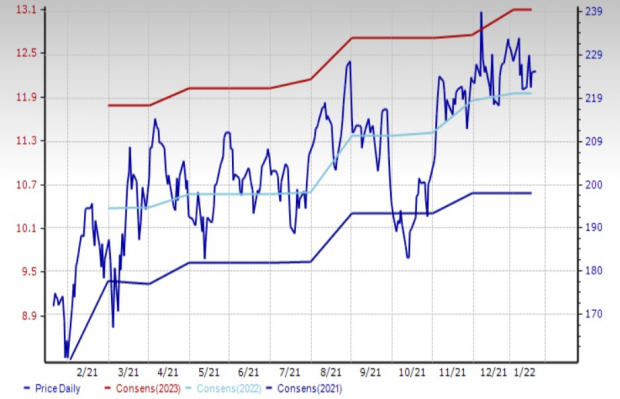

ON Semiconductor Company (ON): The corporate is an unique apparatus producer (OEM) of a huge vary of discrete and embedded semiconductor elements, together with persistent control, common sense, sign processing, reminiscence and alertness explicit built-in circuits (ASICs). It additionally gives foundry products and services. It serves gamers within the automobile, business, clinical, aerospace/protection, communications, networking, wi-fi, shopper, and computing markets

The corporate is some other beneficiary of the present power within the automobile and business markets, either one of which can be in the midst of a powerful enlargement section. Moreover, its extremely differentiated persistent control answers have enabled it to generate new design wins and marketplace proportion features. With auto consumers getting into into long-term provide agreements, the corporate stands to take pleasure in the bettering visibility and higher asset allocation. On Semi could also be smartly situated to capitalize at the rising EV alternative, in addition to the abruptly increasing choice power marketplace (principally sun farms).

ON Semi beat September quarter estimates through 17.6% and then the 2021 estimates for this Zacks Rank #2 corporate higher 32 cents (12.9%). The 2022 estimate higher 51 cents (18.4%).

The stocks are up 80.4% during the last yr.

Worth and Consensus: ON

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Infrastructure Inventory Growth to Sweep The usa

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions can be spent. Fortunes can be made.

The one query is “Will you get into the precise shares early when their enlargement possible is largest?”

Zacks has launched a Particular Record that will help you do exactly that, and lately it’s loose. Uncover 7 particular corporations that glance to achieve probably the most from building and service to roads, bridges, and structures, plus shipment hauling and effort transformation on a virtually not possible scale.

Obtain FREE: Methods to Take advantage of Trillions on Spending for Infrastructure >>

Need the newest suggestions from Zacks Funding Analysis? As of late, you’ll obtain 7 Perfect Shares for the Subsequent 30 Days. Click on to get this loose file

Analog Units, Inc. (ADI): Loose Inventory Research Record

Microchip Era Included (MCHP): Loose Inventory Research Record

NXP Semiconductors N.V. (NXPI): Loose Inventory Research Record

Monolithic Energy Techniques, Inc. (MPWR): Loose Inventory Research Record

ON Semiconductor Company (ON): Loose Inventory Research Record

To learn this newsletter on Zacks.com click on right here.

Zacks Funding Analysis