This tale at the beginning seemed on Zacks

AllianceBernstein Protecting L.P. AB introduced belongings underneath control (“AUM”) for January 2022. The corporate’s initial month-end AUM of $751 billion declined 3.6% from the tip of the prior month. Marketplace depreciation greater than offset overall firm-wide web inflows, which ended in the autumn.

On the finish of January, AllianceBernstein’s Fairness AUM declined 6.9% sequentially to $335 billion. Additionally, Possible choices/Multi-Asset Answers AUM (together with sure multi-asset products and services and answers) used to be down 6.8% to $110 billion. Additional, Mounted Source of revenue AUM used to be $306 billion, which witnessed a three.2% decline from the tip of December 2021.

With regards to channel, month-end Establishments AUM of $333 billion used to be down 1.2% from the former month. Retail AUM used to be $300 billion, which declined 6.3% from the prior-month finish, whilst Non-public Wealth AUM fell 3.3% to $118 billion.

AllianceBernstein’s world achieve and cast belongings steadiness is most likely to spice up top-line enlargement. Alternatively, unfavourable marketplace efficiency stays a drag.

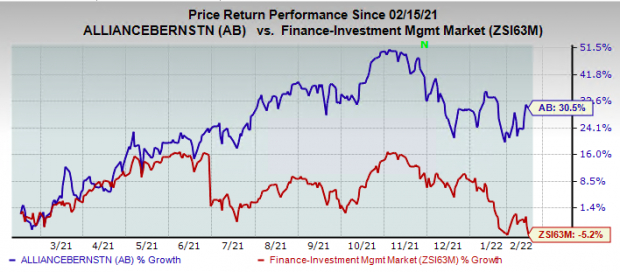

During the last yr, stocks of the corporate rallied 30.5% towards 5.2% decline of the business.

– Zacks

– Zacks

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Recently, AllianceBernstein sports activities a Zacks Rank #1 (Sturdy Purchase). You’ll be able to see the entire listing of these days’s Zacks #1 Rank shares right here.

Efficiency of Different Asset Managers

Franklin Sources, Inc. BEN introduced a initial AUM for January 2022. BEN’s month-end AUM of $1,521.8 billion represented a decline of three.6% from the former month.

Franklin’s AUM used to be suffering from detrimental affects of markets, whilst long-term web flows had been flat.

Invesco IVZ introduced a initial AUM for January 2022. IVZ’s month-end AUM of $1,550.9 billion represented a decline of three.7% from the former month.

Invesco’s AUM used to be suffering from unfavourable marketplace returns, which diminished it through $61 billion. Invesco’s AUM declined through $2.1 billion on account of foreign currency fee actions.

Simply Launched: Zacks Most sensible 10 Shares for 2022

Along with the funding concepts mentioned above, do you want to find out about our 10 height buy-and-hold tickers for the whole lot of 2022?

Remaining yr’s 2021 Zacks Most sensible 10 Shares portfolio returned positive aspects as top as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 corporations lined through the Zacks Rank. Don’t leave out your probability to get in on those long-term buys

Get right of entry to Zacks Most sensible 10 Shares for 2022 these days >>

Need the newest suggestions from Zacks Funding Analysis? These days, you’ll obtain 7 Easiest Shares for the Subsequent 30 Days. Click on to get this loose file

Franklin Sources, Inc. (BEN): Loose Inventory Research File

Invesco Ltd. (IVZ): Loose Inventory Research File

AllianceBernstein Protecting L.P. (AB): Loose Inventory Research File

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis