ZGNX’s Acquisition Information, REGN, BLUE’s Updates & Extra

This tale in the beginning gave the impression on Zacks

It’s been a low-key week for the biotech sector with few pipeline and regulatory updates. Acquisition information grabbed focal point within the sector this week.

– Zacks

– Zacks

Recap of the Week’s Maximum Vital Tales:

Zogenix Up on Acquisition Information: Stocks of Zogenix ZGNX won considerably following information of acquisition by means of UCB for roughly $1.9 billion. Each the firms introduced that UCB would achieve Zogenix for 26.00 in money and a contingent price proper (CVR) for a possible money cost of $2.00 upon EU approval of Fintepla as an orphan medication for the remedy of Lennox-Gastaut syndrome (LGS) by means of Dec 31, 2023. The prematurely attention represents a 72% top rate to Zogenix stocks in response to the 30-day volume-weighted reasonable ultimate inventory value of Zogenix previous to signing. Fintepla is already licensed by means of the FDA and the Ecu Medications Company (EMA) and is below regulatory overview in Japan for the remedy of seizures related to Dravet syndrome in sufferers two years of age and older.

Regeneron Software for Libtayo Label Growth Authorised: Regeneron Prescribed drugs, Inc. REGN introduced that the FDA has accredited for overview the supplemental Biologics License Software (sBLA) for PD-1 inhibitor Libtayo (cemiplimab-rwlc). The sBLA is looking for popularity of the drug together with chemotherapy as first-line remedy in complicated non-small mobile lung most cancers (NSCLC). The company had set a goal motion date of Sep 19, 2022. A regulatory submitting has additionally been lately submitted to the EMA. The sBLA is supported by means of effects from a randomized, multicenter section III be taught that evaluated Libtayo together with a doctor’s collection of platinum-doublet chemotherapy (Libtayo mixture) in comparison to platinum-doublet chemotherapy by myself within the centered inhabitants. The be taught used to be stopped early after the Libtayo mixture demonstrated a vital total survival growth in comparison to chemotherapy by myself.

Regeneron recently has a Zacks Rank #2 (Purchase). You’ll be able to see all the record of these days’s Zacks #1 Rank (Robust Purchase) shares right here.

Regulatory Replace From bluebird bio: bluebird bio BLUE introduced that the FDA has prolonged the overview duration for the biologics licensing programs (BLA) for its lentiviral vector gene remedies – betibeglogene autotemcel (beti-cel) for β-thalassemia and elivaldogene autotemcel (eli-cel) – for cerebral adrenoleukodystrophy (CALD). The regulatory frame prolonged the PDUFA purpose dates for beti-cel and eli-cel to get sufficient time to check further scientific knowledge in the past submitted by means of the corporate in line with knowledge requests by means of the FDA as a part of its ongoing opinions. The guidelines used to be deemed a significant modification. The brand new PDUFA motion dates for bluebird’s lentiviral vector gene remedies are Aug 19, 2022, for beti-cel and Sep 16, 2022, for eli-cel. Stocks have been down in line with the inside track.

Gamida Positive factors on Replace on Omidubicel BLA: Stocks of Gamida Mobile Ltd. GMDA won after the corporate introduced plans to start up a rolling BLA submission for omidubicel. This follows receipt of sure Sort B assembly correspondence from the FDA. The BLA will search popularity of omidubicel as a possible life-saving allogeneic hematopoietic stem mobile (bone marrow) transplant answer for sufferers with blood cancers.

Previous, the regulatory frame asked a revised research of the producing knowledge generated at Gamida Mobile’s wholly owned advertisement production facility to exhibit the analytical comparison to the Lonza scientific production website online that produced omidubicel for section III be taught. Gamida showed attaining an alignment with the FDA that the commercial-grade product and clinical-study product are analytically similar. Following the status quo of the analytical comparison, the FDA agreed to the rolling submission of the BLA for omidubicel. Further scientific knowledge is probably not required to start up the BLA submission.

Efficiency

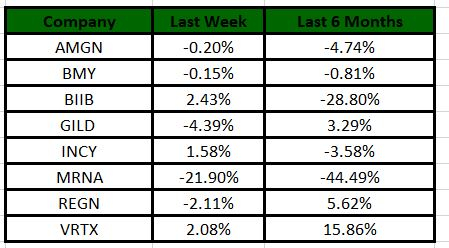

The Nasdaq Biotechnology Index has misplaced 6.15% previously 4 buying and selling periods. A number of the biotech giants, Vertex has won 2.08% all over the duration. Over the last six months, stocks of Vertex have soared 15.86%. (See the remaining biotech inventory roundup right here: Biotech Inventory Roundup: BIIB’s AD Drug Replace, AMGN’s Drug Approval & Different Updates)

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

What is Subsequent in Biotech?

Keep tuned for extra pipeline and regulatory updates at the side of profits updates.

Zacks Names “Unmarried Easiest Select to Double”

From 1000’s of shares, 5 Zacks mavens each and every have selected their favourite to skyrocket +100% or extra in months to come back. From the ones 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

As one investor put it, “curing and combating loads of sicknesses…what must that marketplace be price?” This corporate may just rival or surpass different fresh Zacks’ Shares Set to Double like Boston Beer Corporate which shot up +143.0% in little greater than 9 months and NVIDIA which boomed +175.9% in three hundred and sixty five days.

Unfastened: See Our Most sensible Inventory and four Runners Up >>

Need the most recent suggestions from Zacks Funding Analysis? As of late, you’ll obtain 7 Easiest Shares for the Subsequent 30 Days. Click on to get this unfastened document

Regeneron Prescribed drugs, Inc. (REGN): Unfastened Inventory Research Document

Zogenix, Inc. (ZGNX): Unfastened Inventory Research Document

bluebird bio, Inc. (BLUE): Unfastened Inventory Research Document

Gamida Mobile Ltd. (GMDA): Unfastened Inventory Research Document

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis