Why Must You Dangle Common Well being (UHS) in Your Portfolio?

This tale firstly seemed on Zacks

Common Well being Products and services, Inc. UHS is definitely poised to develop at the again of accretive acquisitions, wholesome best line and a powerful efficiency of its behavioral well being hospitals.

The clinic corporate has a marketplace cap of $10.5 billion and owns acute care hospitals, behavioral well being facilities, surgical hospitals, ambulatory surgical treatment facilities and radiation oncology facilities.

UHS beat on income three times and overlooked the mark as soon as within the remaining 4 quarters, the typical wonder being 17.6%. Courtesy of cast possibilities, this recently Zacks Rank #3 (Dangle) inventory is value protecting directly to these days.

– Zacks

– Zacks

What’s Riding the Inventory?

The clinic group is continuously gaining from cast volumes and its acute care and behavioral well being care amenities. Its best line witnessed a 2010-2020 CAGR of five.5%, led by means of cast segmental contributions, upper admissions and affected person days. Within the first 9 months of 2021, the similar additional larger 10.6% 12 months over 12 months.

This main participant within the clinic business additionally boasts a robust inorganic enlargement tale. Within the remaining reported quarter, UHS opened 157 beds in Las Vegas or even obtained 88 beds during the takeover of the Las Vegas distinctiveness clinic.

Common Well being bought a LEED Scientific Middle micro clinic providing emergency and inpatient care adjoining to the Las Vegas Strip. In 2020, UHS instated 439 beds at its acute care and behavioral well being hospitals. We consider that UHS will proceed making acquisitions that may assist it make bigger its home and global presence.

UHS ceaselessly advantages from its Acute Care section. Since 2012, the typical selection of approved beds in acute care hospitals has been rising, pushing up the revenues. If truth be told, world marketplace sentiments for acute care remedies are somewhat upbeat with North The us accounting for the most important percentage within the house. In 2020 and all through the primary 9 months of 2021, web revenues from this section rose 3% and 18.6%, respectively, 12 months over 12 months.

This clinic participant’s Behavioral platform could also be beautiful robust. Since 2012, moderate approved beds within the behavioral well being facilities were rising, contributing to the highest line. All over 2020 and within the first 9 months of 2021, the similar inched up 0.6% and 5.4% 12 months over 12 months, respectively. This section holds abundant alternatives.

UHS has an outstanding solvency stage, offering it with monetary flexibility. Its long-term debt to capitalization of 36.8% compares favorably with the business moderate of 89.7%. Additionally, its instances pastime earned stands at 17.5X, a lot upper than the business’s moderate of five.7X. If truth be told, it resumed its capital deployment at the again of its cast stability sheet. Because the inception of the present percentage buyback plan in 2014, Common Well being has repurchased greater than 20% of its exceptional stocks.

Then again, UHS’ steep bills proceed to hassle.

Extra Room to Run?

Rising call for for healthcare products and services, accretive acquisitions and a cast acute care platform will most probably force the inventory.

The inventory carries a VGM Ranking of B. Right here V stands for Price, G for Enlargement and M for Momentum with the ranking being a weighted mixture of all 3 components.

The Zacks Consensus Estimate for UHS’ 2021 income signifies an growth of five.4% from the year-ago reported determine.

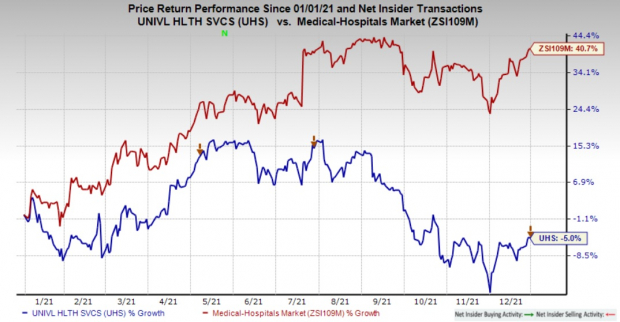

Stocks of UHS have misplaced 5% in a 12 months’s time in opposition to its business’s enlargement of 40.7%.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Shares to Imagine

Some better-ranked shares within the clinical sector are Molina Healthcare Inc. MOH, NextGen Healthcare, Inc. NXGN and AMN Healthcare Products and services AMN.

With a Zacks Rank #2 (Purchase) at this time, Molina Healthcare Inc. is a multi-state controlled care group, taking part completely in government-sponsored healthcare techniques. Its income beat the consensus mark in two of the trailing 4 quarters (lacking the mark in the rest two), the typical wonder being 4%. You’ll be able to see all the listing of lately’s Zacks #1 Rank shares right here.

NextGen Healthcare is a developer and marketer of healthcare knowledge techniques. With a Zacks Rank of two at this time, NXGN has a trailing four-quarter wonder of 16%, on moderate.

AMN Healthcare Products and services is a go back and forth healthcare staffing corporate with a Zacks Rank of one at this time. It has a trailing four-quarter wonder of nineteen.51%, on moderate.

Stocks of NextGen Healthcare have misplaced 2% in a 12 months’s time, whilst the shares of Molina and AMN Healthcare Products and services have rallied 50.8% and 78.5% every.

Zacks Best 10 Shares for 2022

Along with the funding concepts mentioned above, do you want to learn about our 10 best choices for everything of 2022?

From inception in 2012 via November, the Zacks Best 10 Shares received an outstanding +962.5% as opposed to the S&P 500’s +329.4%. Now our Director of Analysis is combing via 4,000 corporations coated by means of the Zacks Rank to handpick the most productive 10 tickers to shop for and dangle. Don’t pass over your likelihood to get in on those shares once they’re launched on January 3.

Be First To New Best 10 Shares >>

Need the most recent suggestions from Zacks Funding Analysis? Nowadays, you’ll obtain 7 Highest Shares for the Subsequent 30 Days. Click on to get this unfastened document

Common Well being Products and services, Inc. (UHS): Unfastened Inventory Research Document

Molina Healthcare, Inc (MOH): Unfastened Inventory Research Document

AMN Healthcare Products and services Inc (AMN): Unfastened Inventory Research Document

NEXTGEN HEALTHCARE, INC (NXGN): Unfastened Inventory Research Document

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis