Will have to Worth Traders Imagine Spectrum (SPB) Inventory Now?

Worth making an investment is well probably the most standard tactics to search out nice shares in any marketplace setting. Finally, who wouldn’t need to to find shares which might be both flying below the radar and are compelling buys, or be offering up tantalizing reductions when in comparison to honest price?

– Zacks

– Zacks

One solution to to find those firms is by way of having a look at a number of key metrics and monetary ratios, lots of that are an important within the price inventory variety procedure. Let’s put Spectrum Manufacturers Holdings, Inc. SPB inventory into this equation and to find out if this is a sensible choice for value-oriented buyers presently, or if buyers subscribing to this system must glance somewhere else for best choices:

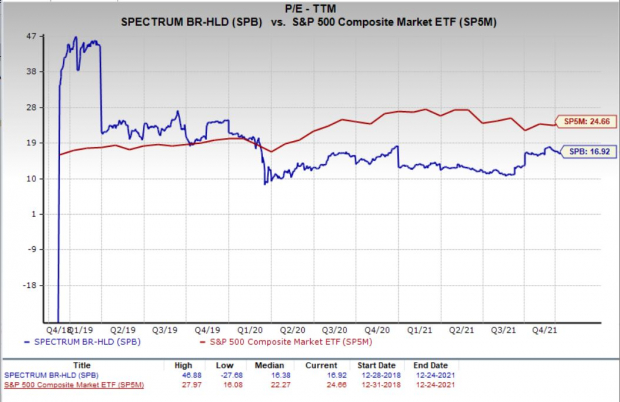

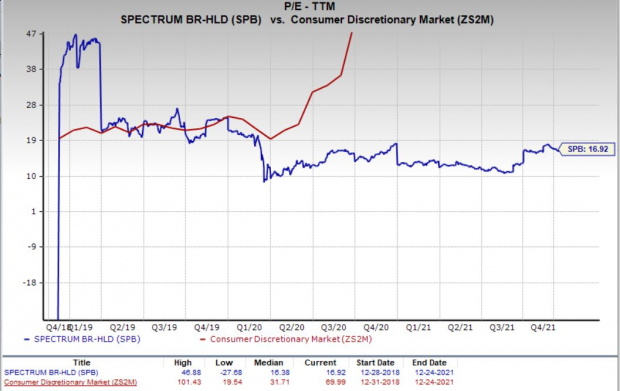

PE Ratio

A key metric that price buyers all the time take a look at is the Value to Income Ratio, or PE for brief. This presentations us how a lot buyers are prepared to pay for every buck of income in a given inventory, and is well probably the most standard monetary ratios on this planet. The most efficient use of the PE ratio is to match the inventory’s present PE ratio with: a) the place this ratio has been prior to now; b) the way it compares to the common for the trade/sector; and c) the way it compares to the marketplace as a complete.

In this entrance, Spectrum has a trailing three hundred and sixty five days PE ratio of 16.92, as you’ll see within the chart underneath:

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

This degree in reality compares lovely favorably with the marketplace at huge, because the PE for the S&P 500 stands at about 24.59. If we center of attention at the long-term PE development, Spectrum’s present PE degree places it underneath its midpoint during the last 5 years.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Additional, the inventory’s PE compares favorably with the Zacks Shopper Discretionary sector’s trailing three hundred and sixty five days PE ratio, which stands at 66.51. On the very least, this means that the inventory is somewhat undervalued presently, in comparison to its friends.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

We must additionally indicate that Spectrum has a ahead PE ratio (value relative to this 12 months’s income) of simply 28.72, which is tad upper than the present degree. So it’s honest to be expecting an build up within the corporate’s proportion value within the close to time period.

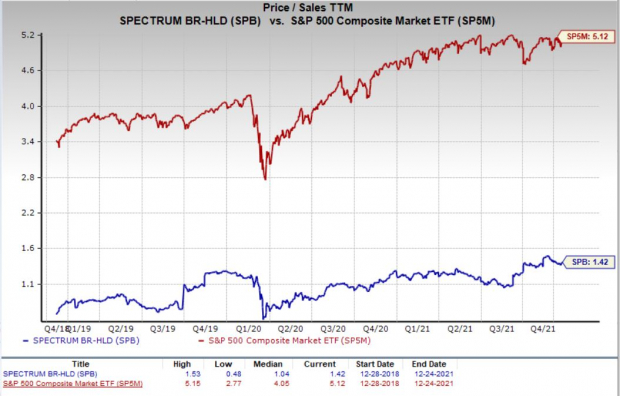

P/S Ratio

Every other key metric to notice is the Value/Gross sales ratio. This way compares a given inventory’s value to its general gross sales, the place a decrease studying is most often thought to be higher. Some other people like this metric greater than different value-focused ones as it seems to be at gross sales, one thing this is a ways tougher to control with accounting methods than income.

Presently, Spectrum has a P/S ratio of about 1.42. That is not up to the S&P 500 reasonable, which is available in at 5.12 presently. Additionally, as we will be able to see within the chart underneath, that is underneath the highs for this inventory specifically during the last few years.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

If the rest, SPB is within the decrease finish of its vary within the period of time from a P/S metric, suggesting some degree of undervalued buying and selling—a minimum of in comparison to ancient norms.

Large Worth Outlook

In combination,Spectrum these days has a Zacks Worth Ranking of A, placing it into the highest 20% of all shares we quilt from this glance. This makes Spectrum a cast selection for price buyers.

What Concerning the Inventory General?

Even though Spectrum may well be a sensible choice for price buyers, there are many different components to believe prior to making an investment on this identify. Specifically, it’s price noting that the corporate has a Enlargement Ranking of F and a Momentum Ranking of C. This offers SPB a Zacks VGM ranking — or its overarching elementary grade — of A. (You’ll be able to learn extra concerning the Zacks Taste Rankings right here >>)

In the meantime, the corporate’s contemporary income estimates were encouraging. The present 12 months has noticed 5 estimates move upper prior to now sixty days in comparison to 3 decrease, whilst the overall 12 months 2021 estimate has noticed 3 upward revision in comparison to one downward in the similar period of time.

This has had a good affect at the consensus estimate regardless that as the present 12 months consensus estimate has risen by way of 19.7% prior to now two months, whilst the overall 12 months 2021 estimate has stepped forward by way of 1.4%. You’ll be able to see the consensus estimate development and up to date value motion for the inventory within the chart underneath:

So, in spite of a Zacks Rank #3, we consider that bullish analyst sentiment and favorable trade components make this price inventory a compelling pick out.

Backside Line

Spectrum is an impressed selection for price buyers, as it’s laborious to overcome its fantastic line up of statistics in this entrance.

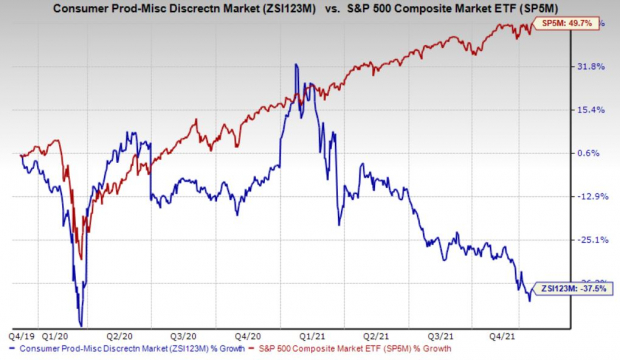

Alternatively, with a gradual trade rank (amongst backside 37% of greater than 250 industries) and a Zacks Rank #3, it’s laborious to get too occupied with this corporate total. In truth, during the last two years, the Zacks Shopper Merchandise – Discretionary trade has obviously underperformed the marketplace at huge, as you’ll see underneath:

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

So, price buyers may need to watch for trade traits to show round on this identify first, however as soon as that occurs, this inventory is usually a compelling pick out.

Infrastructure Inventory Increase to Sweep The us

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions might be spent. Fortunes might be made.

The one query is “Will you get into the best shares early when their enlargement doable is biggest?”

Zacks has launched a Particular File that will help you just do that, and nowadays it’s loose. Uncover 5 particular firms that glance to realize probably the most from development and service to roads, bridges, and constructions, plus shipment hauling and effort transformation on a virtually unattainable scale.

Obtain FREE: Methods to Make the most of Trillions on Spending for Infrastructure >>

Need the newest suggestions from Zacks Funding Analysis? These days, you’ll obtain 7 Very best Shares for the Subsequent 30 Days. Click on to get this loose file

Spectrum Manufacturers Holdings Inc. (SPB): Unfastened Inventory Research File

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis