Power, Financials Main The Fee In 2022

This tale at the beginning gave the impression on Zacks

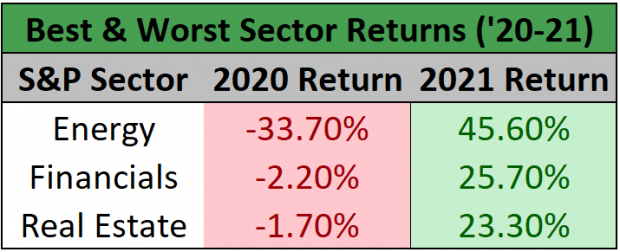

Ultimate yr stunned many traders as 2021 used to be the inverse of 2020 with admire to main marketplace sectors. The 3 worst-performing S&P sectors in 2020 (power, financials, and actual property) reversed path remaining yr and have been the 3 very best performers as we will be able to see underneath.

– Zacks

– Zacks

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

A very powerful caveat with admire to this sector outperformance is that almost all of the positive factors for power and financials in 2021 got here within the first part of the yr. From June to December, each sectors necessarily moved sideways, notching best slight positive factors.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Whilst this relative underperformance in the second one part of the yr can also be considered negatively, the 2 sectors can have merely been taking a wanted breather after beginning out remaining yr extraordinarily sturdy. Power and financials are main the price at the first buying and selling day of the yr and seem set to renew their subsequent leg up. The sphere consolidation all over the remaining six months seems adore it is paving the best way for a repeat of outperformance to start with months of 2022.

With bond yields spiking as of late, we’re going to concentrate on two monetary corporations which might be breaking out to the upside. The Zacks Finance sector is lately ranked #1 out of all 16 sectors. Making an investment within the most sensible sectors and trade teams supplies a continuing tailwind in your making an investment good fortune.

Jefferies Monetary Crew, Inc. (JEF)

Jefferies Monetary Crew is a world monetary products and services corporate that engages in funding banking and capital markets, service provider banking, in addition to selection asset control. JEF gives monetary advisory, debt and fairness underwriting, fairness analysis, wealth control, and company lending products and services. Jefferies Monetary Crew used to be based in 1968 and is headquartered in New York, NY.

JEF trades at a phenomenal valuation (10.1 ahead P/E) and has surpassed profits estimates in every of the remaining 8 quarters. A Zacks #1 (Sturdy Purchase) inventory, JEF maximum lately reported quarterly EPS again in September of $1.51, a +48.04% marvel over consensus. JEF has delivered a median profits marvel of +222.85% over the last 4 quarters, supporting the inventory’s climb of more or less 65% prior to now yr.

Jefferies Monetary Crew Inc. Worth, Consensus and EPS Marvel

Analyst overlaying JEF have larger their full-year profits estimates by means of 4.79% in simply the previous 30 days. The Zacks Consensus Estimate for 2021 EPS now stands at $6.34, representing enlargement of 139.25% relative to 2020. JEF is scheduled to record its ultimate set of ’21 quarterly profits after the bell as of late.

Financial institution of The us Corp. (BAC)

Financial institution of The us is a number one monetary establishment that serves particular person shoppers, small and middle-market companies, in addition to massive companies. BAC supplies a complete vary of banking, making an investment, asset control and comparable services and products. Headquartered in Charlotte, NC, Financial institution of The us supplies products and services to over 66 million shoppers and operates roughly 4,300 retail monetary facilities.

BAC has crushed profits estimates in every of the remaining 3 quarters and trades at a particularly reasonable 12.73 ahead P/E. The corporate has a trailing four-quarter moderate profits marvel of +22.79%. BAC maximum lately reported profits again in October when the company posted EPS of $0.85, a +19.72% marvel over consensus. BAC inventory has been a gradual outperformer over the last yr, returning north of 55%.

Financial institution of The us Company Worth, Consensus and EPS Marvel

The outlet of latest branches together with enhanced virtual functions must proceed to beef up the inventory’s run. BAC maintains a robust stability sheet and liquidity place, and in consequence hiked their dividend remaining yr by means of 17% to 21 cents in keeping with proportion. The corporate’s proportion repurchase plan of $25 billion used to be additionally renewed in October.

A Zacks #2 Purchase, BAC revenues are anticipated to develop just about 5% in 2022. Given its powerful basics, BAC’s spectacular efficiency is predicted to proceed when the corporate studies profits on January 19th.

Those two monetary companies are poised to proceed their momentum as we commence out the brand new yr on a robust be aware.

Zacks Best 10 Shares for 2022

Along with the funding concepts mentioned above, do you want to learn about our 10 most sensible choices for the whole thing of 2022?

From inception in 2012 via November, the Zacks Best 10 Shares received an excellent +962.5% as opposed to the S&P 500’s +329.4%. Now our Director of Analysis is combing via 4,000 corporations lined by means of the Zacks Rank to handpick the most efficient 10 tickers to shop for and hang. Don’t leave out your likelihood to get in on those shares once they’re launched on January 3.

Be First To New Best 10 Shares >>

Need the most recent suggestions from Zacks Funding Analysis? As of late, you’ll obtain 7 Absolute best Shares for the Subsequent 30 Days. Click on to get this loose record

Financial institution of The us Company (BAC): Unfastened Inventory Research Record

Jefferies Monetary Crew Inc. (JEF): Unfastened Inventory Research Record

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis