Dr. Reddy’s (RDY) Q3 Profits, Gross sales Build up 12 months Over 12 months

This tale at the beginning gave the impression on Zacks

Dr. Reddy’s Laboratories Restricted RDY reported third-quarter fiscal 2022 income of 57 cents in keeping with American Depositary Percentage when compared with 41 cents (aside from impairment fees) reported within the year-ago quarter.

– Zacks

– Zacks

In third-quarter fiscal 2022, revenues grew 7.8% yr over yr to $715 million.

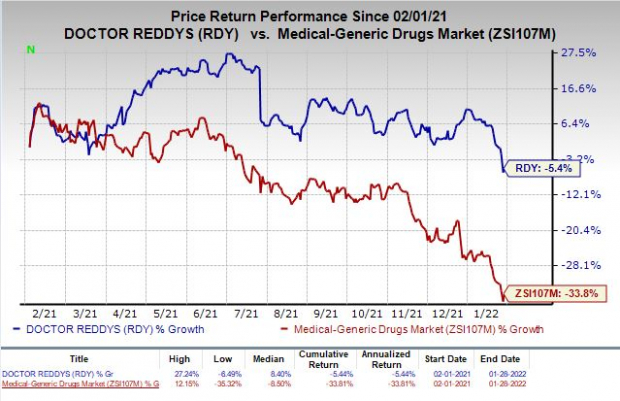

Stocks of the corporate have diminished 5.4% previously yr when compared with the trade’s decline of 33.8%.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Quarter in Element

Dr. Reddy’s experiences revenues below 3 segments — World Generics; Pharmaceutical Services and products & Energetic Elements (“PSAI”); and Proprietary Merchandise and Others.

World Generics revenues had been INR 44.5 billion, up 9% yr over yr, within the fiscal 1/3 quarter. Expansion was once led via the corporate’s new product launches and better gross sales quantity in key markets.

In December 2021, Dr. Reddy’s won emergency-use authorization to fabricate and marketplace the oral anti-viral drug molnupiravir pills (200 mg) for treating grownup sufferers with COVID-19 from the medicine controller basic of India.

The corporate introduced 4 merchandise in North The united states, together with Carmustine injection, Ephedrine Sulphate injection, Valsartan drugs and Venlafaxine ER drugs.

As of Dec 31, cumulatively, 91 generic filings had been pending approval from the FDA (88 abbreviated New Drug Packages [ANDAs] and 3 new drug programs). Of those 91 ANDAs, 45 are Para IVs and 24 have first-to-file standing.

PSAI revenues had been INR 7.3 billion, up 4% from the year-ago quarter essentially pushed via new product launches.

Revenues within the Proprietary Merchandise section got here in at INR 1.4 billion, reflecting a lower of 8% yr over yr. Revenues within the section additionally declined 22% sequentially owing to popularity of a license charge from the sale of its United States and Canada territory rights for Elyxyb (celecoxib oral answer, 25 mg/mL) to BioDelivery Sciences World, Inc. BDSI in second-quarter fiscal 2022.

In August 2021, Dr. Reddy’s entered right into a definitive asset acquire settlement with BioDelivery Sciences, by which the previous bought its United States and Canada territory rights for Elyxyb to the latter.

Dr. Reddy’s won an prematurely fee of $6 million from BioDelivery Sciences upon final of the settlement.

Analysis and building bills larger 1% yr over yr to $56 million. The corporate is enterprise the improvement of latest merchandise focused on more than a few markets.

Promoting, basic and administrative bills had been $207 million, up 7% yr over yr upper, attributable to investments in gross sales and advertising and marketing for key manufacturers and better annual increments.

Our Take

In third-quarter fiscal 2022, Dr. Reddy’s best and backside strains registered year-over-year enlargement.

Then again, the corporate continues to stand value erosion, particularly within the North The united states generics marketplace, which is adversely impacting gross sales.

Zacks Rank & Shares to Believe

Dr. Reddy’s these days carries a Zacks Rank #5 (Robust Promote).

Best-ranked shares within the healthcare sector come with Vertex Prescribed drugs Included VRTX and Cara Therapeutics, Inc. CARA, each carrying a Zacks Rank #1 (Robust Purchase) at the present. You’ll see the entire checklist of as of late’s Zacks #1 Rank (Robust Purchase) shares right here.

Vertex’s income estimates had been revised 2.5% upward for 2022 over the last 60 days. The inventory has larger 4.8% previously yr.

Vertex’s income have surpassed estimates in every of the trailing 4 quarters

Cara Therapeutics’ loss in keeping with percentage estimates have narrowed 1.3% for 2022, over the last 60 days.

Cara Therapeutics’ income surpassed estimates in 3 of the trailing 4 quarters and overlooked the similar at the different instance.

Zacks Names “Unmarried Highest Pick out to Double”

From hundreds of shares, 5 Zacks mavens every have selected their favourite to skyrocket +100% or extra in months to come back. From the ones 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

As one investor put it, “curing and combating loads of sicknesses…what must that marketplace be price?” This corporate may rival or surpass different fresh Zacks’ Shares Set to Double like Boston Beer Corporate which shot up +143.0% in little greater than 9 months and NVIDIA which boomed +175.9% in 12 months.

Unfastened: See Our Best Inventory and four Runners Up >>

Need the newest suggestions from Zacks Funding Analysis? Nowadays, you’ll be able to obtain 7 Highest Shares for the Subsequent 30 Days. Click on to get this loose record

Dr. Reddy’s Laboratories Ltd (RDY): Unfastened Inventory Research File

Vertex Prescribed drugs Included (VRTX): Unfastened Inventory Research File

BioDelivery Sciences World, Inc. (BDSI): Unfastened Inventory Research File

Cara Therapeutics, Inc. (CARA): Unfastened Inventory Research File

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis